Any screenshots and details of functionality may no longer be relevant. Below are some related posts that are more current:

- Creative Breakdown for Flexible Format (Jul 13, 2025)

- Problem with GA4 Integration (Jun 24, 2025)

- A Complete Guide to Meta Ads Attribution (Jun 9, 2025)

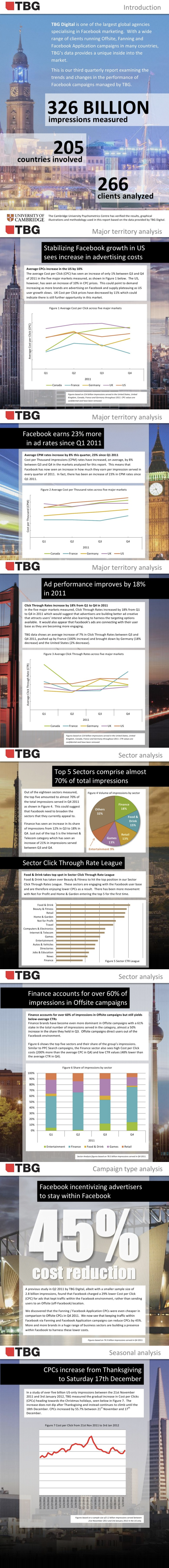

TBG Digital has put out a Global Facebook Advertising Report for the first quarter of 2012 that provides some interesting insights on the direction of engagement and costs of Facebook ads.

Following are some highlights, along with my thoughts on each item. You can read the TBG slides in their entirety here. I’ve also compiled most of them into an infographic at the bottom of this blog post.

Average CPC and CPM up in the US

What’s interesting is that this report covers Canada, France, Germany, the UK and US, and CPC was up for all five markets combined by only 1% while the US was up by 10%. So one can infer that other than the US, CPC was actually down in the other markets.

Meanwhile, Cost Per Million Impressions (my preferred method of advertising) is also up by 8% this quarter and 23% since the first quarter of 2011. Of the five markets measured, CPM is highest in the US and lowest in France.

Why are advertising costs rising in the US? TBG speculates that this could be because demand is increasing in the US while user growth and supply plateau. Meanwhile, it’s a great opportunity to advertise on Facebook in France and Germany.

Click Through Rates are up… or are they?

Click through rates have increased by 18% from the first to fourth quarters in 2011, though the US has seen a drop by 2% between the third and fourth quarters. In other words, ad performance is down in the US while costs are rising.

So what is going on here? Costs are rising while performance is taking a hit?

First of all, keep in mind that during the first quarter, Facebook rolled out the new seven ad format, making each individual ad unit less effective (though they have also recently launched Premium to potentially counter that).

Another potential cause is that the Finance industry accounts for more than 60% of Facebook ad impressions with destinations off of the social network. This is critical for two reasons:

- Reports have shown Facebook charged 29% lower CPC for ads that kept traffic within Facebook during the second quarter and 45% lower during the fourth quarter; and

- Click through rate is lowest for the Finance industry.

So if the Finance industry (which is a pillar of the US economy) is making up 60% of ads going off of Facebook, that would certainly have a negative impact on both performance and cost.

What does this mean for you?

I guess it all depends on where and in what industry you do business. My assumption is that unless you are in the Finance industry, results are likely across the board and settling on stable.

But this also underlines something I’ve recommended for some time: Keep your advertising on Facebook. Drive Facebook users to your Page, your apps or your shared content. Click throughs will be higher and costs lower.

What do you think of the TBG Facebook Report? Are your costs going up?